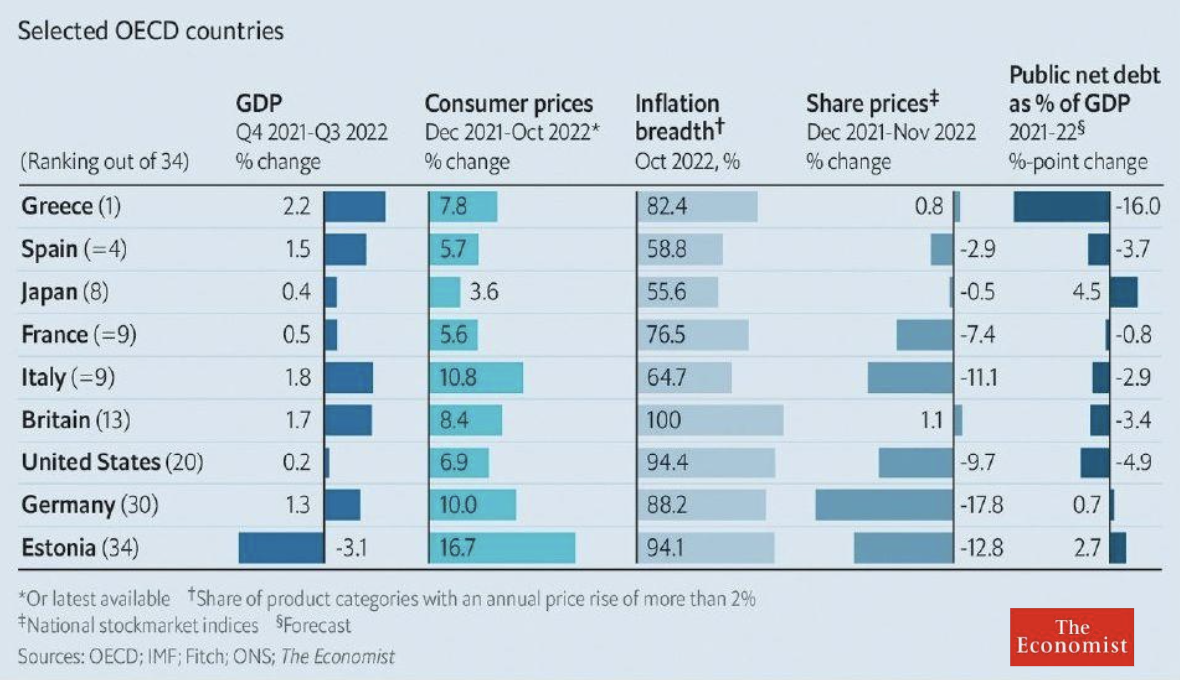

Over the last few years, we see Greece as a success story that brings hope for more nations who struggle. For the better part of the previous decade, Greece was synonymous with economic decline and political exceptionalism in Europe. The Greek economy contracted by 26% between 2007 and 2014, driving hundreds of thousands into unemployment. After more than a decade of bailouts and austerity measures that pulled Greece from the brink of bankruptcy and a eurozone exit, the country has rebounded to (according to Economist) the top economic performer for 2022 as number one in "2022’s unlikely economic winners"! Now as one of the turnaround stories that Greece sees, its Innovation Ecosystem is growing fast and rising to a promising European hub in what is already one of the most attractive destinations in the world, synonymous with quality of life and happiness.

Greek Tech’s turning point

2018 was a turning point for the Greek tech scene. It already had its first midsize exit success stories, such as Efood (sold to Delivery Hero), Taxibeat (sold to Daimler), Innoetics (sold to Samsung) despite the shaken Greek economy. It was that same year that the Greek government launched a $260M fund of funds, Equifund, that created 6 new early-stage VCs and fueled another 5 existing VCs who focused on the later stage tech startups of the nation.

Since then, all key metrics of an Innovation Ecosystem have been skyrocketing, supported by a quickly repairing economy. According to reports from Endeavor Greece - the global non-profit who has been present in the country since 2012 - startup debt and equity financing went from just $110M in 2018 to a whopping $1,4B in 2022, with year on year growth rates varying from 80% to 120%. The number of active Greek startups went from 60+ in 2018 to 290+ in 2022 and sizable exits started making global headlines and paved the way for many big-tech companies to set up operations in Greece and tap into a high-skilled and full of creative energy national workforce. Exits like Softomotive (acquired by Microsoft), Instashop (acquired by Delivery Hero), Think Silicon (acquired by Applied Materials), Augmenta (acquired by CNHI) and dozens more raised the value of exits from just $90M in 2018 to more than $500M+ in 2022. The Greek tech ecosystem’s growth was so compelling, that Europe’s leading tech portal (backed by Financial Times) Sifted wrote a report called, Greeking Out: Greece bids for Tech Glory.

The first half of 2023 showed no signs of slowing down, against all global trends, with 6 new exits of a total value $300M+ and 35 new funding rounds of a total amount $450M+. A testament to the high quality and persistent Greek entrepreneurship. As Techcrunch puts it: in a location-optional world Greece opens its wings.

Greece ahead - 2030

We have every reason to believe that the momentum of the Greek tech ecosystem is only going to get stronger. World-class Greek tech scaleups such as Viva Wallet (official Unicorn after JP Morgan acquired 49% stake), Blueground, Workable, Flexcar, Skroutz, Epignosis, ActionIQ, Beat and Persado are category leaders in their domains and have reached or are expected to reach unicorn status within the next 2 years. Currently there are another 15 unicorns launched by Diaspora Greeks and another 90 foreign scaleups who have launched operations in Greece, such as Unicorn startups Checkout.com, Klarna, GWI, Panther Labs and June Homes.

The new sovereign fund of Greece, the Hellenic Bank of Development and Innovation, has gathered $2.1B in assets under management, dedicated for tech investments, and has signed massive sovereign co-investment multi-billion agreements with ADQ and Mubadala, starting a new era of foreign funds being aggressively active in the country as well as a widely capitalized VC market.

An army of dozens of next generation Greek deep-tech startups is paving the way for the next phase of the Greek Tech Ecosystem. They produce world-class technologies in industries where Greece has a global advantage, such as maritime-tech, life sciences and ag-tech and will land massive, world-class M&A and investment deals.

By the year 2030 we expect the Greek Innovation Ecosystem to have 8+ Unicorns and a total worth of $30B (10% of GDP), up from $9B in 2022. By 2030, we also expect to receive 200+ new foreign startups to launch operations in Greece and create 100K+ new jobs. We expect to have 15 new VCs where 5-6 of them will focus on an untapped Series A and B stage and will have a total of $2.4B in assets under management. The debt and equity capital raised by the Greek tech startups will be close to $4-6B and overall job creation could reach up to 250.000 people, boosted by existing and new Innovation Centers that will be established in the country.

Greece is scaling up fast

Today, the Greek economy is growing at impressive rates supported by political stability and a pro-growth national strategy. The Greek stock exchange market ranked as one of the top performing stock exchange markets in the world for 2022, the national banks are picking up lending and the $80B National Recovery and Resilience Plan, named Greece 2.0, is positioned to reposition Greece as a world class market, focusing on transforming infrastructure, digitalization and innovation.

And the Greek Transformation is already happening. World-class projects like Europe's largest urban development project, Ellinikon by Lamda Development, are bringing the Greek infrastructure and capabilities to the new era and puts Greece on the global map as a rising economy. Many more Greek owned companies like Aegean Airlines, Mytilinaios, Viohalco, Titan, NBG, Antenna Group and Cosmote are not just leading the Greek market transformation but are ranked amongst the best companies in the world in their respective fields.

Foreign companies will continue to storm Greece for R&D and Innovation Centers: Microsoft’s $1B investment plan, Cisco’s Digitalization Program, Pfizer’s growing R&D centers, JP Morgan's plans for a big Payments Innovation Center, Tesla Innovation Center for robots and battery tech, Applied Material’s low-powered CPU’s software development, Celonis as well as WV's partnership with Greek government and many more are launching various high-quality, high-tech operations in Greece and already employ 7.000+ people. At the same time Foreign Direct Investments will continue to grow as Greece ranks among the top 10 destinations for migration by Ultra High Net Worth Individuals (UHNWI) where almost 1,200 millionaires moved to Greece in 2022 alone.

Reborn as an emerging innovation hub after years of economic turmoil, Greece combines the energy of a nation determined to reimagine its future with the deepest of historical roots. And you can sense it in the air that Greece and its capital, Athens, is the place to be for the years to come.